|

The information shared in "How to Teach Kids to be Millionaires" by Cuttie Bacon, III, Ph.D, a self made millionaire, is essential. He has a time-tested formula and practical examples that build financial responsibility into our everyday lives. The purpose of this post will be to highlight some of the main points he covers in hopes of stimulating interest in reading his book. After all, he is someone who knows, a millionaire! Money, Money MoneyThe song by The O'Jays called, "For the Love of Money." I highly recomend that you go to Youtube to get yourself in the mood for this post. The lyrics say, "some people do bad things with it." And one of those things Dr. Bacon points out in raising your child is with what he calls, "throw away" money for candy and toys. "Investment" over "saving" is the mantra he professes in every area. Though the book was written in the year 2000, the concepts can easily be adopted for today's 2020+ lifestyle especially through a pandemic. 3 Ways to Teach Financial LiteracyHere are 3 of the main points the book that address teaching financial responsibility:

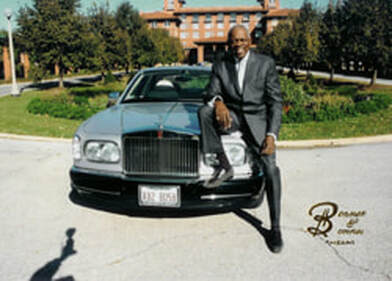

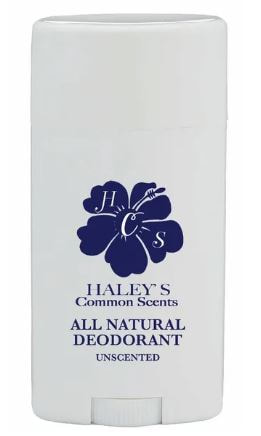

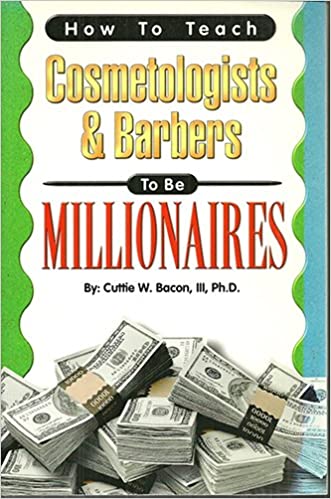

What children see is what they do, and if the child sees their parents spending money recklessly, that is sure to follow in the child. Starting with the clothes on their backs, the author carves out a path over the course of the child's time in the home for investing and redirecting $2 per day. For example, he states that the average household spends $1,000.00 per year just on clothes, toys and gifts. According to the US Department of Agriculture's website, today's standards (referenced for 2020) the total expense to raise a child is $233,610. Now, let's break that down per year and per category of clothing only to make an accurate apples to apples comparison. Of the total spent on a child, the breakdown is as follows: 18% Food 29% Housing 15% Transportation 9% Healthcare 6% Clothing 15% Child Care and Education 7% miscellaneous. So, for clothing, 6% of $233,610 is $14,016.60 over 18 years. For ease of numbers, let's go with $14,000.00. So, per year, it is $14,000.00/18 (assuming the child moves out at 18 years old. This becomes rounding up $777.78 per year. The author is spot on in his estimates as he adds toys and gifts to his number to get $1,000.00 per year. He posits that with careful planning, that number can be reduced and redirected to build a healthy nest egg for the child to use later in life. The formula starts with a mindset of practicality. As an infant, your child isn't too particular about designer clothing styles. That understanding allows the parent to leverage practicality over prudishness. The author suggests going to thrift stores, or use of older sibling's clothes. Outlet stores like Marshall's have clothing that has never been worn and didn't sell in certain markets. These stores move that merchandise to other regions and mark it down for quick sale to cut their losses. The proposal is to use this practical approach before the child may start asking for the latest styles and trends that they grow out of so quickly. The hamster wheel the parent could be on which would require a constant stream of money to be "thrown away," should instead take advantage of the specials and marked down items early on as a more strategic use of money. Also, the author Bacon recommends to ask relatives/friends who want to give gifts of clothing or other items to encourage the use of gifting cash or "financial securities." That enables the parent to direct the mindful use of that money toward inexpensive clothing or in good investments. A well-meaning Aunt or Uncle may purchase a top of the line baby onesie that can only be worn for 2 months before it is outgrown. The practical use of money may not be top of mind when staring into your cute child's eyes. Of course, you want the best for them, and, most importantly, you want the child to be taken care of well beyond the sparkle of the outfit will last. The money that will be saved can then be re-directed into investments. The recommendation is to take the $2 per day you save from paying premium price on clothing and other gifts can be redirected to an investment of $730 per year for 18 years. With interest rate of 15% (using known stocks/other investments), this will amount to well over $100,000. The author encourages practicality and mindfulness. Dr. Bacon speaks from experience. He has three children of his own, is a former school superintendent and college professor, so he's dealt with many young people over the years. Though it may be tempting to then go splurge on an item the parent may want, Mutual Funds, IRA's and stocks are introduced as a safer way to store the savings for growth and dividends. While we are going through a pandemic, this approach will be even easier to implement because children in higher grades are practicing remote learning and spending limited time face-to-face around other children. The styles/designer clothes and trends are still present, but less will be needed in their closets because it will last longer throughout the week. Dress-up or fancy clothing isn't used up as much over the week since time spent inside is increased where the family is likely dressed down and staying comfortable in pajamas or sweats. It is easy to find lounge ware on the clearance racks or in the sales sections online. The centerpiece of this short, easy to read book, "How to Teach Kids to be Millionaires" is that children can be encouraged to start a business of their own to teach the basics of money. Every dollar gained will be from a dollar earned instead of being on an allowance. This is an important understanding for children to experience first hand. The number of children that start businesses seems to be on the upswing. As an example, I'd like to share the story of 10 year old Haley Anderson of Haley's Common Scents All Natural Deodorants. She started her business when she was only 9 years old. Her entire family came to showcase her merchandise at my business, Afriware Books, Co in early 2020 (pictured below). She is an entrepreneur and CEO of Haley's Common Scents! Haley's Common Scents who focuses on the utilization of essential oils to produce a variety of essential oil blends, candles, natural deodorant, and bath and body products. Haley is a model other children can aspire to. A willing heart can go a long way. Sometimes, it is the adults that need to adjust their mindset in support of such ventures more-so than the children. The inquisitive mind of a child can be leveraged to explore many an invention or new approach to old-outdated ideas. The combination of a child's curiosity with the guidance and support of the parents can introduce innovations thought unimaginable. It certainly doesn't hurt to try, and you never know what you'll learn along the way. Even doing chores can be thought of as a business for the independent contractor-child. Dr. Bacon encourages the use of payroll over allowance, so even doing dishes, or putting away clothing will transfer into monetary value. The amounts do not have to be exorbitant, but a specific value can be assigned so the connection will be made between doing tasks and earning money. The author points out that this is the best preparation for adult life. Rare is it to find anyone making a living by just receiving money without exchanging anything else in return. Every dollar and cent earned is another opportunity to teach counting, how many days of making a certain amount are needed before they can buy certain items, and other terms used in financial literacy. Financial responsibility can be made fun when it starts early on. Though many of these points apply easiest to children in the household, they can also be adapted to the classroom when it comes to teaching about stocks and bonds. Children can select one stock and watch it increase or decrease in value over time. Selection of the stock, and growth or decline will encourage analysis, critical thinking and reasoning about how current events may have an impact on corporations. Managing Money for CosmetologistsDr. Bacon has also written a book for Barbers and Cosmetologists. After all, some children will start business cutting hair for their brothers and become quite good at it. I also encourage you to pick up this book because there are important lesser known anecdotes that will prove useful. For example, some of the chapters are, "Put Yourself on a Weekly Salary," "You are the Last to Get Paid," "How to Buy a Salon," and "How to Buy a Car and Not get Ripped Off." He also has encouraging affirmations such as: Spend Your Money Slow, |

AUDIOBOOKSMERCHGIFTSjoin email listACADEMIC BOOKSblog Author/

|

- Store

- Blog

- AUDIO BOOKS

- EBOOKS

- SEARCH

- Welcome

- GoFundMe

- TUCC

- Events

- READING GUIDE

- AUTHOR INFORMATION

- ARTIST BIO/PRICE

- NNEDI OKORAFOR BOOKS

- PODCAST

- LARUE'S HAND IN CLAY

- About Us

- FREQUENTLY ASKED QUESTIONS

- BOOK FAIR /SCHOOLS / CLUBS

- Photo Gallery

- EJP BOOK DRIVE

- Videos

- Newsletter/Articles

- Archives

- External Links

- Afriware Statement on COVID-19

- GREATER LAKES

- Afriware Merchandise

- AFFILIATE INFO

- SEBRON GRANT ART DESIGNS

- Mother's Day Bundles

- CARTOON

- ROBOTS

- STEM

AFRIWARE BOOKS CO. A COMMUNITY BOOKSTORE SERVING:

|

|

Melrose Park, IL

|

|

,AFRIWARE BOOKS, CO,

1033 SOUTH BOULEVARD, OAK PARK, IL 60302 708-223-8081 ONLINE SUPPORT: Thurs-Fri. 4-6pm Sat. 12-2pm, IN PERSON EVENTS: afriwarebooks.com/events |

Want to try a great website builder, try Weebly at: https://www.weebly.com/r/9SAD4V

RSS Feed

RSS Feed